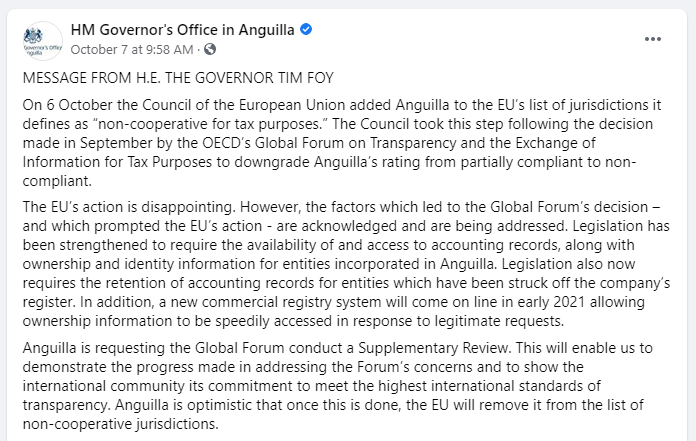

On 6 October the Council of the European Union added Anguilla to the EU's list of jurisdictions it defines as "non-cooperative for tax purposes." The Council took this step following the decision made in September by the OECD's Global Forum on Transparency and the Exchange of Information for Tax Purposes to downgrade Anguilla's rating from partially compliant to non-compliant.

The EU's action is disappointing. However, the factors which led to the Global Forum's decision - and which prompted the EU's action - are acknowledged and are being addressed. Legislation has been strengthened to require the availability of and access to accounting records, along with ownership and identity information for entities incorporated in Anguilla. Click here to read full article

2020-10-12